pay indiana tax warrant online

The card owner may call 1-888-604-7888 to process the payment refer to Payment Location Code. Your browser appears to have cookies disabled.

The Indianapolis News From Indianapolis Indiana On September 4 1964 2

To let us know that you would like to subscribe to e-Tax Warrant Search Services mail the completed User.

. How do I pay a tax warrant in Indiana. INTIME provides access to manage and pay. Be ready to enter your letter ID or tax warrant.

Know when I will receive my tax refund. Questions regarding your account may be forwarded to DOR. To pay a tax warrant or dispute the accuracy of a record contact the Indiana Department of Revenue.

Payment by credit card. Find Indiana tax forms. Pay Your Property Taxes.

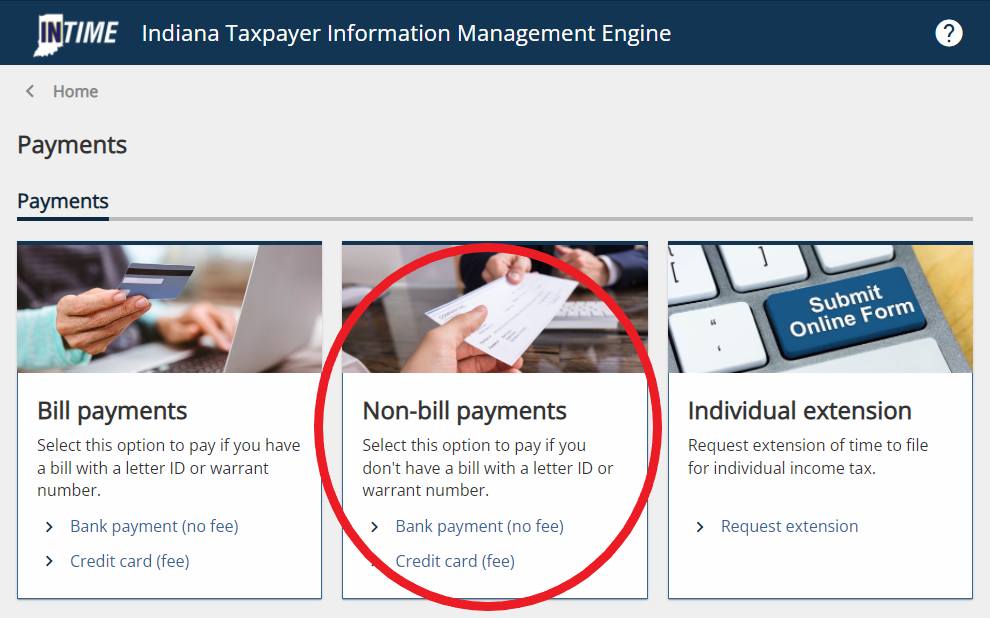

Tax Warrant Payment Methods. The Indiana Taxpayer Information Management Engine known as INTIME is the Indiana Department of Revenues DOR e-services portal. To make an Indiana tax warrant payment online visit the Indiana Taxpayer Information Management Engine.

The following fees apply. To pay on-line please click the secure MAKE A PAYMENT link below. Reports can be sorted by taxpayer name or warrant number.

About Doxpop Tax Warrants. Tax warrant payments can be mailed money order or cashiers check to the Sheriffs Office or paid online using the following website. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

How to Sign Up. Credit cards debit cards and e-checks you can pay by phone 877 690-3729 Jurisdiction Code is 2405 and on-line at. Find Indiana tax forms.

Our service is available 24 hours a day 7 days a week from any location. If you have an account or would like to create one or if you. Cookies are required to use this site.

This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card. Doxpop provides access to over current and historical tax warrants in Indiana counties. Questions regarding your account may be forwarded to DOR at 317.

Doxpop provides access to over current and historical tax warrants in Indiana counties. On-line payment companies charge processing fees for their services.

/cloudfront-us-east-1.images.arcpublishing.com/gray/TT232ZGFP5PGFJDLPW3GFC7OOY.jpg)

Deputies Warn Of New Tax Scam Ahead Of Filing Deadline

![]()

Taxpayer S Guide To Indiana Dor Tax Warrants

Internet Sales Tax Definition Types And Examples Article

Florida Dor Tax Resolutions Consequences Of Back Taxes

Sheriff S Office Hendricks County In

New York State Back Taxes Find Out Tax Relief Programs Available

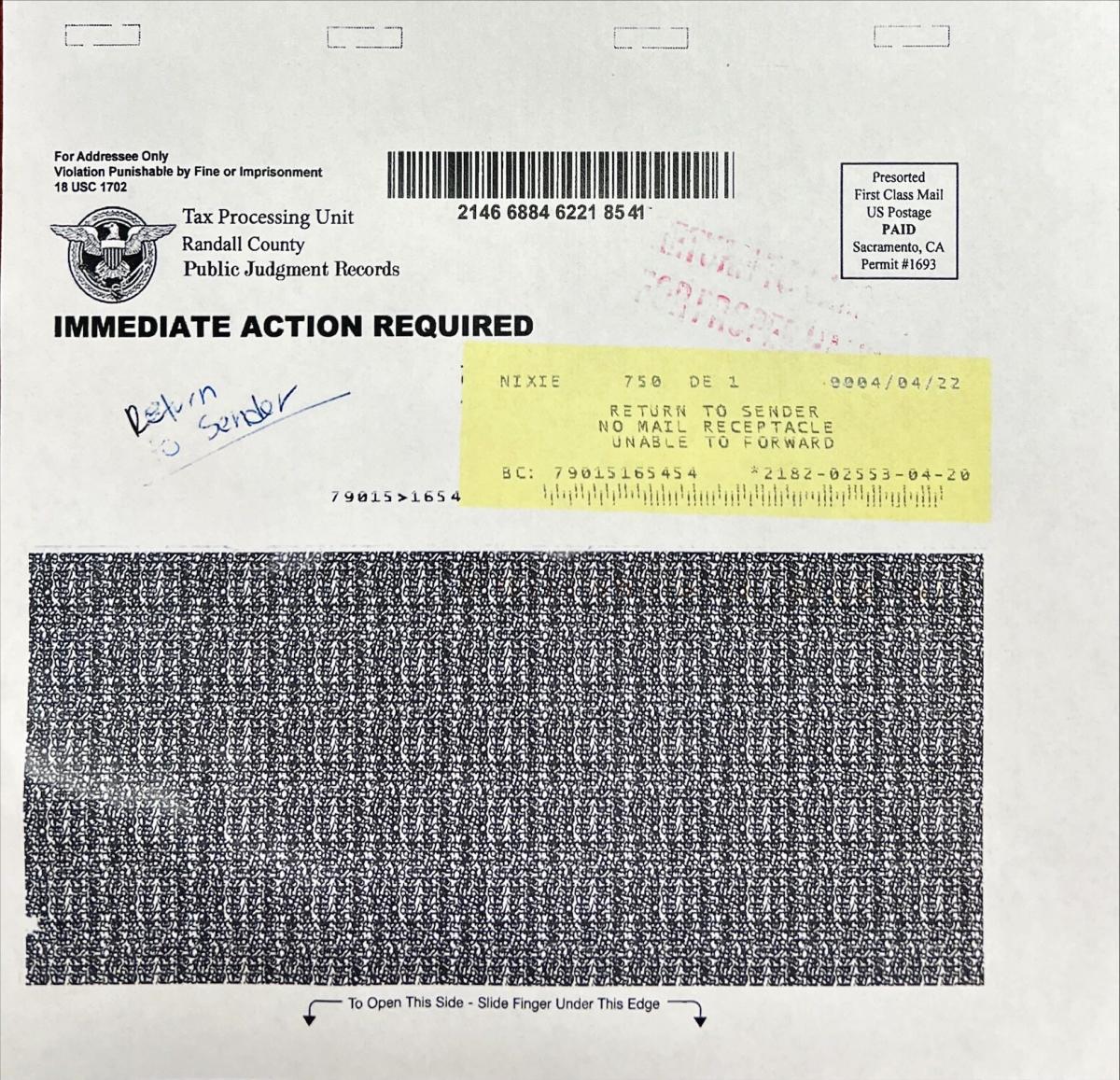

Fake Tax Warrarnts Warning Fake Tax Lien Warrants Received In Larimer County

Fraudulent Tax Debt Letters Claiming Distraint Warrant Are A Scam Randall County Says

Lsnjlaw What Happens After The Eviction Hearing

Dor How To Make A Payment For Individual State Taxes

City Of New Haven Tax Bills Search Pay

The Indianapolis Star From Indianapolis Indiana On December 20 1985 Page 20

Dor Completing An Indiana Tax Return

Owing Money To The Indiana Department Of Revenue Dutton Legal Group Llc

Indiana Military And Veterans Benefits The Official Army Benefits Website